- News

- Business News

- India Business News

- L&T close to buying out Siddhartha in Mindtree

Trending

This story is from January 28, 2019

L&T close to buying out Siddhartha in Mindtree

Boby Kurian & Shilpa Phadnis | TNN

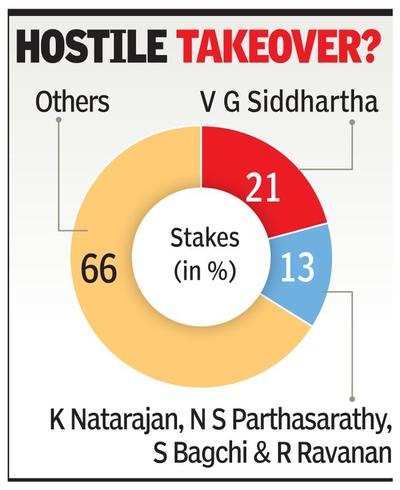

Mumbai: Engineering and construction conglomerate L&T is said to have taken an enabling resolution to strike a deal to buy Coffee Day founder V G Siddhartha’s 21% stake in mid-tier IT services company Mindtree, people directly aware of the matter said.

This comes even as the four founders of the Bengaluru-headquartered Mindtree have opposed moves by Siddhartha, the company’s largest shareholder, to sell shares to L&T.The latest developments raised the prospects of the first ever hostile takeover move in India’s $160-billion software exports industry.

The enabling resolution has entrusted L&T chief executive S N Subrahmanyan to enter into appropriate agreements with Siddhartha and his investment entities that hold stakes in Mindtree. This followed a series of meetings between L&T top brass and Siddhartha in recent weeks.

L&T is expected to formally unveil a Mindtree share-purchase in the coming days after taking care of legal formalities. Sources said L&T might announce that it has mopped up Siddhartha’s shares and some more, taking it up to 25%, which would trigger a mandatory open offer to public shareholders.

However, an income tax department missive issued last week prohibiting Siddhartha from transferring 4.2% of his holding in Mindtree is expected to delay the share sale by a few days. Siddhartha and Coffee Day are expected to move the CBDT to furnish a bank guarantee and separate collaterals to lift the prohibitory order, which is intended only to protect the department’s revenue.

The takeover move has been gathering momentum for almost six months, during which L&T and Siddhartha tried to win the approval of Mindtree founders — Krishnakumar Natarajan, N S Parthasarathy, Subroto Bagchi and Rostow Ravanan — who together own a stake of slightly over 13%.

The four founders are also in hectic, last-minute parleys to mount a counter offer to buy back Siddhartha’s shares. They have reached out to family offices and other long-term investors to secure equity and financing support, but might require additional time to firm up any offer, sources said.

The founders are working with a Mumbai-based investment bank, also a technology sector specialist, to help them sew up a counter offensive. Storied American investor KKR is seen as a possible back-up for the founders — although it might come with some riders — given its flexibility to extend both equity and financing support.

Mumbai: Engineering and construction conglomerate L&T is said to have taken an enabling resolution to strike a deal to buy Coffee Day founder V G Siddhartha’s 21% stake in mid-tier IT services company Mindtree, people directly aware of the matter said.

This comes even as the four founders of the Bengaluru-headquartered Mindtree have opposed moves by Siddhartha, the company’s largest shareholder, to sell shares to L&T.The latest developments raised the prospects of the first ever hostile takeover move in India’s $160-billion software exports industry.

The enabling resolution has entrusted L&T chief executive S N Subrahmanyan to enter into appropriate agreements with Siddhartha and his investment entities that hold stakes in Mindtree. This followed a series of meetings between L&T top brass and Siddhartha in recent weeks.

L&T and Siddhartha could not be reached for immediate comments on Sunday evening.

L&T is expected to formally unveil a Mindtree share-purchase in the coming days after taking care of legal formalities. Sources said L&T might announce that it has mopped up Siddhartha’s shares and some more, taking it up to 25%, which would trigger a mandatory open offer to public shareholders.

However, an income tax department missive issued last week prohibiting Siddhartha from transferring 4.2% of his holding in Mindtree is expected to delay the share sale by a few days. Siddhartha and Coffee Day are expected to move the CBDT to furnish a bank guarantee and separate collaterals to lift the prohibitory order, which is intended only to protect the department’s revenue.

The takeover move has been gathering momentum for almost six months, during which L&T and Siddhartha tried to win the approval of Mindtree founders — Krishnakumar Natarajan, N S Parthasarathy, Subroto Bagchi and Rostow Ravanan — who together own a stake of slightly over 13%.

The four founders are also in hectic, last-minute parleys to mount a counter offer to buy back Siddhartha’s shares. They have reached out to family offices and other long-term investors to secure equity and financing support, but might require additional time to firm up any offer, sources said.

The founders are working with a Mumbai-based investment bank, also a technology sector specialist, to help them sew up a counter offensive. Storied American investor KKR is seen as a possible back-up for the founders — although it might come with some riders — given its flexibility to extend both equity and financing support.

End of Article

FOLLOW US ON SOCIAL MEDIA