- News

- India News

- BJP vows to rejig tax slabs, simplify GST

Trending

This story is from April 9, 2019

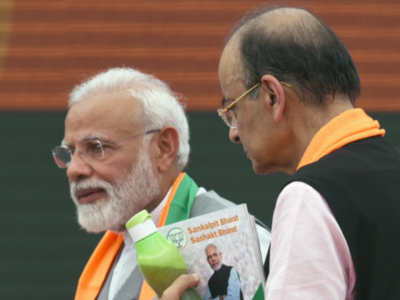

BJP vows to rejig tax slabs, simplify GST

NEW DELHI: BJP is looking to revise the tax slabs in an effort to lower the burden on the middle-class and simplify the goods and services tax (GST) if voted back to power.

“Our economic policy has been guided by the principle of lowering the tax rate and improving compliance, thereby broadening the tax base... We will continue with our policy in the similar manner — lowering of tax rate thereby rewarding honest tax payers and improving compliance,” the party said in its manifesto, released on Monday.

On GST, too, BJP said, lower rates had helped improve tax collections, especially for the states.

The idea of lower income tax is to ensure more cash with consumers, which increases their purchasing power, a statement that PM Modi and finance minister Arun Jaitley have repeatedly made in the past five years. In fact, the panel to rewrite the IT laws has been tasked with reviewing the slabs. In the interim budget, the government had decided to leave those earning up to Rs 5 lakh out of tax net.

The manifesto takes credit for the government’s term seeing the most rapid growth in the post-liberalisation period, while maintaining fiscal prudence. A separate section mentions India will be the third largest economy by 2030 and its size treble to $10 trillion by 2032.

It will use tourism and cluster services as vehicles for creating employment. All Unesco heritage sites in the country will be upgraded to international level facilities.

It promised to make India a global manufacturing hub. As part of this, it endeavours to be in top 50 of the Ease of Doing Business index, strengthen the Companies Act, unveil a new industrial policy and follow a network approach for growth.

“Our economic policy has been guided by the principle of lowering the tax rate and improving compliance, thereby broadening the tax base... We will continue with our policy in the similar manner — lowering of tax rate thereby rewarding honest tax payers and improving compliance,” the party said in its manifesto, released on Monday.

On GST, too, BJP said, lower rates had helped improve tax collections, especially for the states.

The idea of lower income tax is to ensure more cash with consumers, which increases their purchasing power, a statement that PM Modi and finance minister Arun Jaitley have repeatedly made in the past five years. In fact, the panel to rewrite the IT laws has been tasked with reviewing the slabs. In the interim budget, the government had decided to leave those earning up to Rs 5 lakh out of tax net.

Apart from its promise on reducing taxes, BJP appeared to be taking credit for navigating the economy out of the ‘Fragile Five’ bracket in 2014 and making it a “bright spot”, with macroeconomic stability and fastest growing major economy tag. The government has faced repeated attacks from the opposition for its economic policies and is accused of not creating enough jobs.

The manifesto takes credit for the government’s term seeing the most rapid growth in the post-liberalisation period, while maintaining fiscal prudence. A separate section mentions India will be the third largest economy by 2030 and its size treble to $10 trillion by 2032.

It will use tourism and cluster services as vehicles for creating employment. All Unesco heritage sites in the country will be upgraded to international level facilities.

It promised to make India a global manufacturing hub. As part of this, it endeavours to be in top 50 of the Ease of Doing Business index, strengthen the Companies Act, unveil a new industrial policy and follow a network approach for growth.

End of Article

FOLLOW US ON SOCIAL MEDIA